Great Suggestions For Choosing Forex Software

Wiki Article

How To Choose A Good Starter Platform That Will Not Cause Emotional Investment When Investing In Crypto

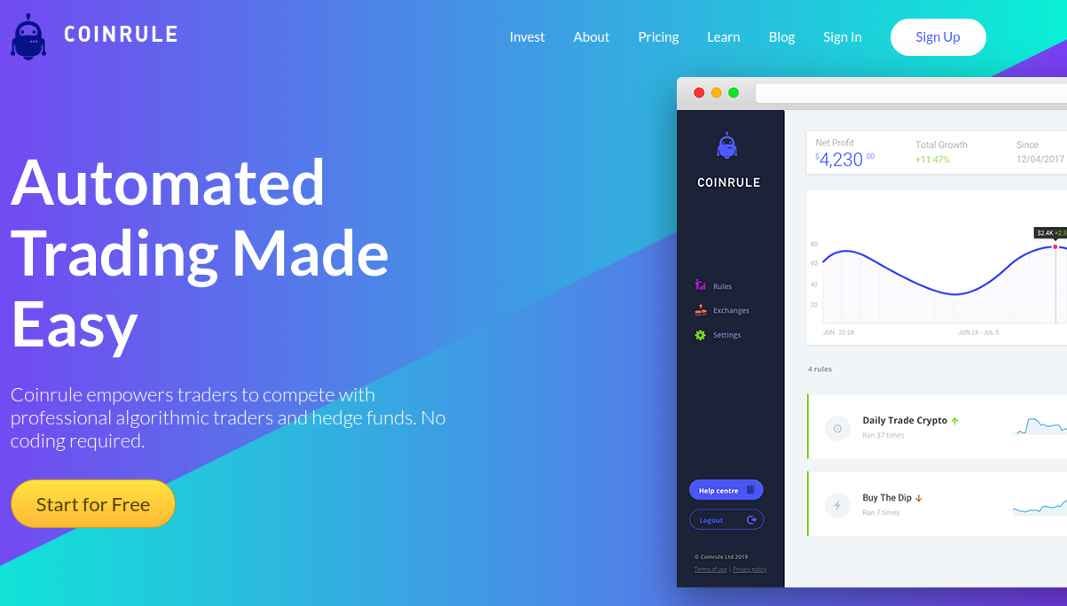

It is a risky and emotionally charged when you invest in crypto. It is essential to select a platform that matches your investment objectives and prevents making emotional choices. Here are some tips to help you choose the best platform. Security- Your assets must be secured by robust security measures, such as 2-factor authentication and encryption, safe storage as well as private key storage.

User-friendly interface: The system must offer a simple interface that is simple for users to navigate and understand, so that they can stay on in the loop and make educated decisions.

Reputation - Look for an organization with a solid reputation in the field. Also, read reviews on forums as well as online to find out the past performance of the platform.

Cost: Compare the costs of different platforms to figure out which platform offers the greatest value for money.

Support for customers: Choose an online platform that provides excellent customer service. This will guarantee that you get quick and efficient help if you ever need it.

Tools to manage and track your portfolio Make sure to select an investment platform that has robust portfolio tracking tools and management tools to help you manage your investments and make informed decisions.

Regulation - Make sure you choose a platform that is licensed and has a strong compliance program to protect your investments.

These guidelines will assist you in choosing the right platform for you and will help you avoid making emotional decisions that can negatively affect your investments. Read the top rated algorithmic trading crypto for more advice including crypto trading backtester, algo trading platform, crypto backtesting, automated trading system, best trading bot, stop loss in trading, free trading bot, automated forex trading, automated crypto trading, rsi divergence cheat sheet and more.

How Do You Deal With Your Emotions To Stay Clear Of Emotional Investment When Investing In Crypto

Investing cryptocurrencies can be volatile and emotionally charged. In order to avoid making risky decisions, it's essential to know what your feelings are. These are some tips to help you understand how your emotions affect crypto investing. For instance, you could be more likely to take unintentional decisions when you're anxious or stressed.

Step back a bit If you're overwhelmed or emotionally stricken Take the time to take a break and spend some time to contemplate your options. You might want to consult your financial advisor, a friend, or trusted colleague.

Keep a diaryKeep a record of your investment decisions as well as the emotions associated with these decisions can help you recognize patterns and take more informed choices in the future.

Mindfulness is a method of practice that can help you remain at peace, even when there are volatile markets.

Stay updated. Learn as much as you can about the crypto market and the various assets you're thinking of investing in to make informed decisions.

You can stay clear of impulse-driven actions and make educated cryptocurrency investments by controlling your emotions. Read the top backtesting for more recommendations including trade indicators, algorithmic trade, crypto trading bot, what is backtesting in trading, stop loss, automated system trading, cryptocurrency trading bot, what is algorithmic trading, backtesting trading strategies, best trading bot for binance and more.

What Are The Best Long-Term Strategies To Stay Clear Of Emotional Investment When You Invest In Cryptocurrency

You should avoid making emotionally driven investments when investing in crypto. It is better to concentrate on long-term plans. Here are some suggestions to help.-Set your investment goals clearly. Understanding your goals will ensure that you are focussed on your long-term plan even when markets are volatile.

Diversify you portfolio. Diversifying your portfolio could help to reduce risk and also the impact that a single investment can have on your portfolio in general.

Avoid the practice of market timing. The process of determining the right time to buy or sell can be emotional, stressful and stressful. Instead, focus on the long-term strategy and diversify your investment portfolio.

Keep to your plan - Even when the market fluctuates, it is important to stick to your investment goals and have a broad portfolio. Don't make decisions based on market trends.

Keep yourself informed - Stay up-to-date with the cryptocurrency market and the assets that you invest in. However, don't be too excited or over-analyzing about your investments. Trust that your long-term strategy will work.

It is possible to avoid emotional investment decisions by focusing on long-term strategy and investing in cryptocurrency that meet your objectives and fall within your risk tolerance. Read the recommended crypto bot for beginners for website info including backtesting tool, backtesting trading strategies, position sizing trading, trading with indicators, algo trading, trade indicators, automated software trading, best forex trading platform, algorithmic trade, backtesting tool and more.

How To Avoid Emotional Investment In Cryptocurrency

You should only put in the is the amount you are able to afford to loose in cryptocurrency investments to stay clear of emotionally charged investing. Here are some tips to help you achieve that target. Make a budget. Find out the amount you are able to invest and then stick to it. Don't put in more than you are able to afford.

Beware of borrowing money. Utilizing credit to invest may make it harder to earn profits. This can lead to poor investment decisions. You should adhere to your budget and only pay the amount you can comfortably afford.

The emotions of your investors shouldn't influence your investment decisions. Focus on your investment goal and do not let your emotions influence your choices.

Diversifying your Portfolio can help you to manage risk, lessen the impact of any single investment on your overall portfolio , and limit the possibility of losing money.

Don't be enticed by returns. It is not a good idea to invest because assets are performing well or because others have invested in them. Stay true to your investment strategy and don't let the fear of missing out determine your investment decisions.

You can avoid emotional investment decisions that could result in financial loss by investing only the amount you can afford to invest. Instead, stick with the strategy that best suits your goals and fits within your tolerance for risk.